Decoding Your Credit Score: What It Means and How to Improve It

In today's financial landscape, your credit score is more than just a number; it's a key that unlocks various opportunities, from securing loans and credit cards to renting an apartment and even obtaining certain insurance policies. Yet, for many, the intricacies of how this three-digit figure is calculated and what it truly signifies remain shrouded in mystery. Understanding your credit score, what factors influence it, and how to actively improve it is essential for navigating your financial life successfully. This comprehensive guide will demystify the world of credit scores, empowering you with the knowledge to build and maintain a strong financial reputation.

What Exactly is a Credit Score and Why Does It Matter?

A credit score is a numerical representation of your creditworthiness – a snapshot of how likely you are to repay borrowed money. Lenders, landlords, and other service providers use this score to assess the risk of doing business with you. A higher credit score generally indicates a lower risk, leading to more favorable terms and interest rates. Here's why your credit score matters:

- Loan and Credit Card Approvals: A good credit score significantly increases your chances of being approved for loans (mortgages, auto loans, personal loans) and credit cards with attractive limits and rewards.

- Lower Interest Rates: Lenders offer their best interest rates to borrowers with the highest credit scores. Even a small difference in interest rates can save you thousands of dollars over the life of a loan.

- Better Credit Card Terms: Access to premium credit cards with perks like travel rewards, cashback, and 0% introductory APRs often requires a good credit score.

- Renting an Apartment: Landlords often check credit scores as part of their tenant screening process. A good score can increase your chances of securing your desired apartment.

- Insurance Premiums: In some cases, insurance companies may use credit scores to determine premiums. A better score can translate to lower insurance costs.

- Utility Services: Some utility companies may check your credit score and require a security deposit if your score is low.

- Even Employment: While less common, some employers may check credit reports as part of their background checks, particularly for positions involving financial responsibility.

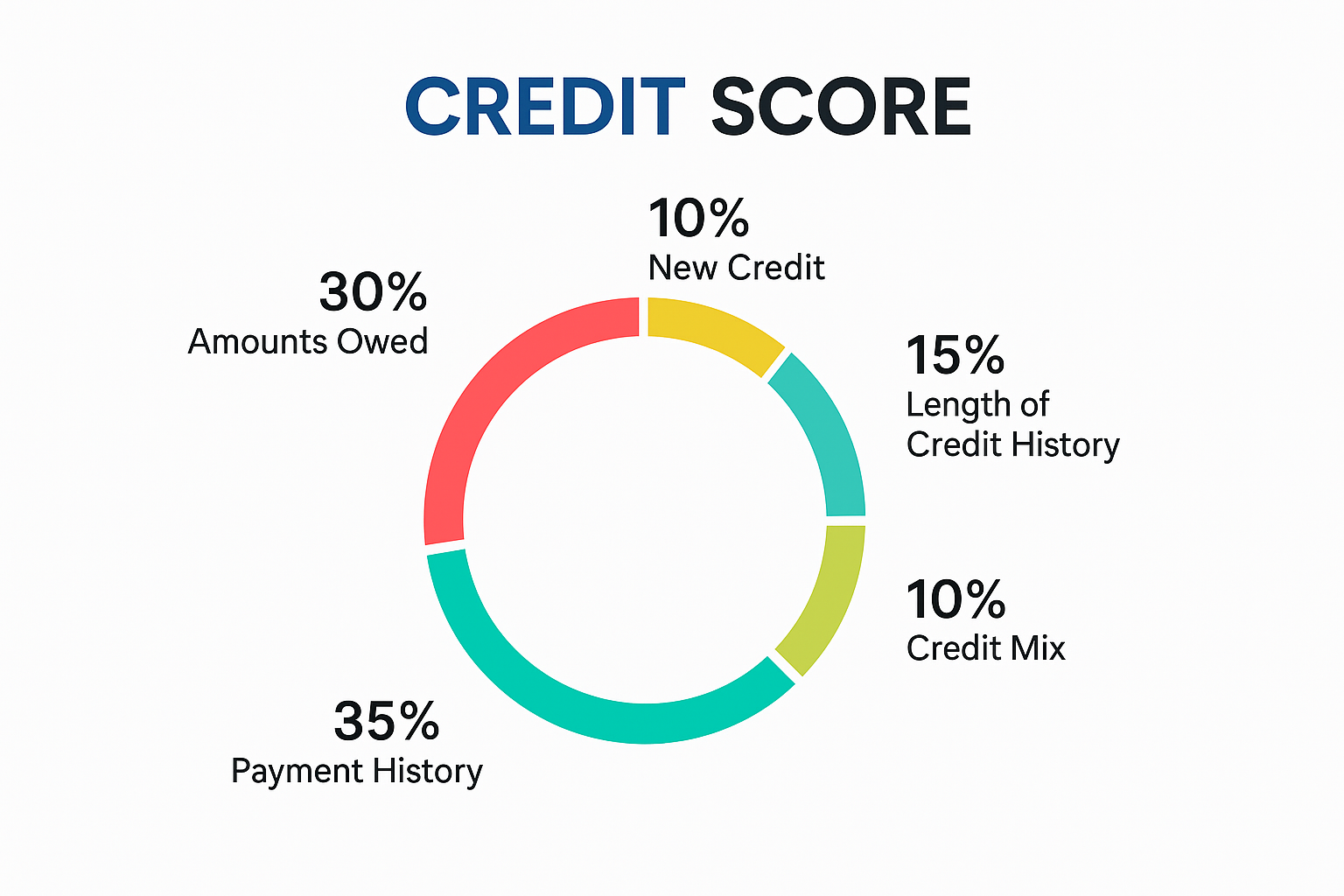

The Key Factors That Influence Your Credit Score:

While the exact algorithms used to calculate credit scores are proprietary, several key factors consistently play a significant role:

- Payment History (35%): This is the most crucial factor. Paying your bills on time, every time, is paramount. Late payments, missed payments, and defaults can severely damage your score and stay on your credit report for years.

- Amounts Owed (Credit Utilization) (30%): This looks at the amount of credit you're using compared to your total available credit. A high credit utilization ratio (using a large percentage of your available credit) can negatively impact your score. Aim to keep your utilization below 30%, and ideally below 10%.

- Length of Credit History (15%): A longer credit history generally indicates a lower risk to lenders. The age of your oldest and newest accounts, as well as the average age of all your accounts, is considered.

- Credit Mix (10%): Having a mix of different types of credit (e.g., installment loans like mortgages or auto loans, and revolving credit like credit cards) can positively impact your score, showing you can manage different types of credit responsibly.

- New Credit (10%): Opening many new credit accounts in a short period can lower your score. Hard inquiries (when you apply for new credit) can also have a small, temporary negative impact.

Understanding Credit Score Ranges:

Credit scores typically range from 300 to 850. Different lenders may have their own specific cutoffs, but generally, the following ranges apply:

- Excellent (800-850): You'll likely qualify for the best interest rates and terms.

- Very Good (740-799): You'll still have access to very good rates and terms.

- Good (670-739): You'll likely be approved for most loans and credit cards, but interest rates might be slightly higher.

- Fair (580-669): You may have difficulty getting approved for the best offers, and interest rates will likely be higher.

- Poor (Below 580): You may struggle to get approved for credit and will likely face very high interest rates if you do.

How to Improve Your Credit Score: Actionable Steps You Can Take

Improving your credit score takes time and consistent effort, but it's an investment that pays off significantly in the long run. Here are actionable steps you can take:

- Pay Bills On Time, Every Time: Set up automatic payments or reminders to ensure you never miss a due date.

- Keep Your Credit Utilization Low: Aim to use no more than 30% of your available credit on each credit card. Ideally, keep it below 10%. Consider paying down balances before your statement closing date.

- Don't Open Too Many New Accounts at Once: Only apply for credit when you genuinely need it.

- Leave Old, Unused Accounts Open (If They Have a Positive History): Closing older accounts can reduce your overall available credit and shorten your credit history.

- Correct Errors on Your Credit Report: Regularly review your credit reports from all three major credit bureaus (Equifax, Experian, TransUnion) for any inaccuracies and dispute them promptly. You can access free copies of your reports annually at AnnualCreditReport.com.

- Consider Becoming an Authorized User: If a trusted friend or family member with good credit adds you as an authorized user to their credit card, their positive payment history can help boost your score.

- Be Patient: Building a good credit score takes time. Be consistent with positive financial habits.

The Importance of Checking Your Credit Report:

Your credit report is the foundation upon which your credit score is built. It contains your credit history, including payment activity, account balances, and any negative information like bankruptcies or collections. It's crucial to review your credit reports regularly for any errors or fraudulent activity that could be negatively impacting your score. You are entitled to one free credit report from each of the three major credit bureaus 1 annually.