The Ultimate Guide to Creating a Budget That Actually Works (and Sticks!)

Are you tired of wondering where your money goes each month? Do you feel like you're constantly playing catch-up with your finances? You're not alone. Many people struggle to gain control over their spending and build a solid financial foundation. The good news is that creating a budget doesn't have to be a restrictive or complicated process. In fact, a well-designed budget can be your ultimate tool for achieving financial clarity, reaching your goals, and finally feeling in control of your money. This comprehensive guide will walk you through a step-by-step process to create a budget that not only works for your unique circumstances but also helps you stick to it for long-term success.

Step 1: Track Your Income – Know What's Coming In

The first crucial step in creating an effective budget is to have a clear understanding of your income. This isn't just about your regular paycheck. Consider all sources of income, including:

- Salary/Wages: Your net income (after taxes and deductions) is what you should focus on for budgeting purposes.

- Freelance Income: If you have side hustles or freelance work, factor in the average monthly income after accounting for any associated expenses.

- Investment Income: Include any regular income from dividends, interest, or rental properties.

- Other Sources: This could include alimony, child support, or any other consistent income streams.

Be meticulous in tracking your income for at least one month to get an accurate picture. You might be surprised by small but consistent income sources you hadn't fully considered.

Step 2: Identify Your Expenses – Where Does Your Money Go?

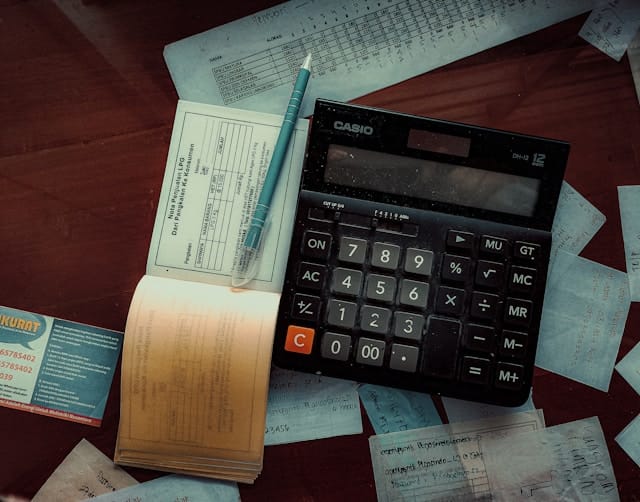

This is often the most eye-opening part of the budgeting process. To effectively manage your money, you need to know exactly where it's currently going. There are several ways to track your expenses:

- Review Bank and Credit Card Statements: Go through your statements for the past month (or ideally, a few months) to categorize your spending. Most banks and credit card companies offer digital tools that can help you categorize transactions.

- Use a Budgeting App: Numerous apps (e.g., Mint, YNAB, Personal Capital) allow you to link your accounts and automatically track your spending.

- Keep a Spending Journal: For a more manual approach, record every expense you make for a week or two. This can be particularly helpful for identifying small, recurring expenses you might otherwise overlook.

Once you've gathered your spending data, categorize your expenses into two main types:

- Fixed Expenses: These are recurring expenses that are generally the same amount each month, such as rent/mortgage payments, loan payments, insurance premiums, and subscription services.

- Variable Expenses: These are expenses that fluctuate from month to month, such as groceries, utilities, entertainment, dining out, and clothing.

Continuing the Process (Outline for the Rest of the Article):

- Step 3: Set Your Financial Goals – What Do You Want Your Money to Do?

- Short-term goals (e.g., saving for a down payment, paying off credit card debt).

- Medium-term goals (e.g., saving for a car, a vacation).

- Long-term goals (e.g., retirement, buying a house).

- Explain how goals provide motivation and direction for your budget.

- Step 4: Choose a Budgeting Method That Suits You:

- 50/30/20 Rule: Allocate 50% to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budget: Allocate every dollar of your income to a specific category (income - expenses = zero).

- Envelope System: Use cash in different envelopes for variable spending categories.

- Budgeting Apps: Leverage technology for automated tracking and categorization.

- Discuss the pros and cons of each method.

- Step 5: Create Your Budget – Putting It All Together:

- Allocate your income to different expense categories and savings goals based on your chosen method.

- Identify areas where you can potentially cut back or reallocate funds.

- Emphasize the importance of being realistic and flexible.

- Step 6: Track Your Progress and Adjust as Needed – Staying on Course:

- Regularly review your actual spending against your budget (weekly or monthly).

- Identify any overspending areas and make necessary adjustments.

- Celebrate your successes and stay motivated.

- Step 7: Make it a Habit – Building Long-Term Financial Control:

- Treat budgeting as an ongoing process, not a one-time task.

- Be patient with yourself and don't get discouraged by occasional setbacks.

- Revisit and adjust your budget as your income, expenses, and goals change.

Conclusion:

Creating a budget that truly works and sticks is a journey, not a destination. By understanding your income, tracking your expenses, setting clear goals, choosing the right method, and consistently reviewing and adjusting your plan, you can gain control of your finances and build a more secure and prosperous future. Start today, be patient with yourself, and celebrate the small victories along the way.